Christine Lagarde, President of the European Central Bank, once said:

“Trust is the currency of our financial system,” and of course she is right 🙂

People today want two things in their banking transactions. First, their advisor actually gets their goals and second, keeps their private details safe.

So, we can say that there is a digital convenience on one side and growing concerns about privacy and compliance on the other. That is why secure video calls have become the bridge that enables both to work together.

In this article, we’ll see how secure video calls bring together the human side of face-to-face chats with the speed and ease of modern banking.

Let’s start.

Why Trust Needs a Digital Bridge

Financial advice can be a retirement plan, a first mortgage, or a portfolio rebalancing. Shortly, it’s about futures, and that is why it is deeply personal. So, when people get this advice online, they are naturally concerned.

In order to ease these concerns and keep a human touch, banks are now using secure video calls in their online interaction.

Imagine video calls as a suspension bridge. On one side, clients seek digital transformation in banking:

- Speed,

- Convenience, and

- Accessibility.

On the other side, they need human reassurance:

- Eye contact,

- Empathy, and

- Personalized guidance.

So, as a solution, secure video calls can close this bridge. Because when companies use secure video calls, they balance technology with humanity. They ensure clients never feel lost in a sea of automation. That is the core value this technology offers for the financial sector.

Growing Demand for Security and Personalization

Security is non-negotiable in finance. But security alone is not enough. People also crave personalization.

A recent Accenture study found that 91% of consumers prefer brands that recognize them and provide tailored recommendations. This means your customer demands compliance and context altogether.

What does personalized financial advice mean, then?

What kind of services are included?

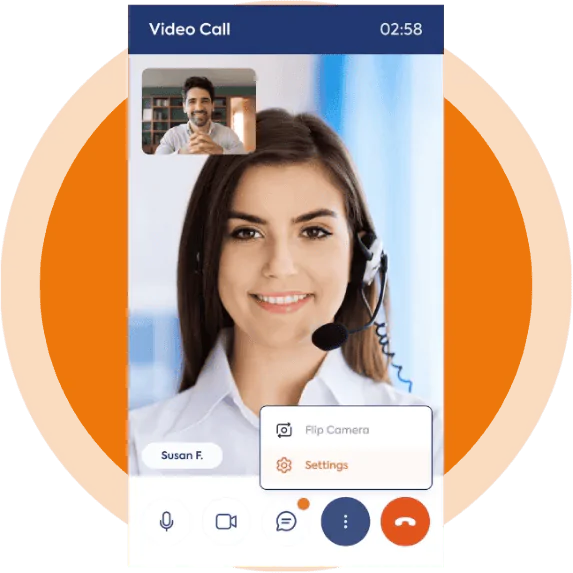

In a conventional branch, customers previously had to sit opposite a desk to feel secure, put their signature on papers for regulatory purposes, and set up a time weeks out for their benefit. Thanks to video banking, those identical services are shifting to the internet, so;

- Face-to-face trust now happens over secure video calls; clients still get that personal connection, but with time back in their day.

- Compliance is handled through encrypted, audit-ready digital communication instead of piles of paperwork. It keeps things secure and saves both sides from endless forms.

- Convenience means clients can jump into a quick meeting from their kitchen table, office desk, or even while on the move. It’s faster, easier, and fits into real life.

Sure, your team can totally take care of all that stuff we chatted about earlier via message or a call, but they might not feel super comfortable. However, after chatting with them via video, their feelings changed to: “It’s just like going to the bank, but way quicker and easier.”

That is exactly what differentiates your service from your competitors and makes your client a long-term, trustworthy customer.

From Branch to Browser: The Rise of Video Banking

When you use video banking, you are saving the most valuable thing for your client. It is their time!

The main motivation behind the rise of video banking is that people think they waste time when they go to a bank, and if there is any way to do banking stuff, they try 🙂

Since clients can do everything they do with a physical bank, sooner or later, they are going to demand video calls. Because the only thing you can’t do with video banking is treat your customer to a coffee. Well, actually, you can do it through an online delivery too.

Let’s see the main services clients can now access through video banking, showing how traditional branch activities are shifting online:

Everyday account services: From opening a new account to updating account details, clients can complete simple banking tasks face‑to‑face or online.

Loan and credit card applications: Advisors can walk clients through forms and approvals securely on screen, reducing paperwork and branch visits.

Mortgage consultations: Your clients can review loan options and sign preliminary documents with their advisor on a secure video call.

Estate planning and retirement advice: Retirees can meet with specialists, share documents, and receive guidance without leaving home.

Wealth management reviews: High‑net‑worth clients can schedule personalized check‑ins, track portfolio performance, and adjust strategies in real time.

These examples highlight how video banking transforms familiar branch services into secure, digital experiences that still feel personal.

How Call Center Studio Orchestrates Secure Customer Interactions

While video may be the “stage,” it takes the right platform to ensure the performance is flawless.

As a financial services contact center built in the cloud, Call Center Studio empowers institutions to deliver secure customer interactions that inspire confidence.

Let’s look together at what your company will have when using the CSS video call service:

- Bank-grade security: End-to-end encrypted video calls, ensuring regulatory compliance for GDPR, PCI-DSS, and other frameworks.

- Personalized financial advice at scale: Advisors can use CRM-integrated data to tailor conversations, ensuring each client feels understood.

- Compliant video communication: Every consultation can be logged, monitored, and stored securely, which is vital for audits and dispute resolution.

- Flexible cloud infrastructure: Institutions can scale video call services across multiple geographies, with no heavy IT overhead.

- Enhanced engagement tools: From screen-sharing to digital document signing, the advisor’s “toolbox” is always within reach.

Want you know what it looks like in action?