Online payment fraud is expected to exceed $206 billion globally by 2025, with a significant share driven by ATO attacks.

According to the Federal Trade Commission,

- 1.13 million identity theft reports in 2024

- 284,651 of these thefts involved phone scams, a prevalent tactic in account takeover fraud.

Attackers are increasingly targeting contact centers as their easiest entry point whether through:

- Automated credential stuffing: Using bots to try to steal usernames and passwords

- Social engineering: Manipulating agents into giving up info

- Phishing: Tricking users into revealing login credentials through fake emails, texts, or calls.

So you need:

- Tighter protocols,

- Serious backup, and

- Sharper tools.

Let’s be ready together 🥷🏻

The Anatomy of ATO Fraud in Contact Centers

One weak link, and suddenly you’re refunding fraud losses, notifying affected users, and fielding angry tweets.

ATO fraud contact center threats often start with stolen or leaked credentials then spiral fast.

Fraudsters use convincing tactics (and scripts) to:

- Work around poorly trained agents,

- Pretend to be real customers,

- Overwhelmed support teams or outdated tools,

Sometimes, they even pass ID checks like it’s no big deal, wild, right?

You and your agent should be alert if you see the following red flags:

- Inconsistent caller information,

- Urgency to change passwords or phone numbers, and

- Pressure to bypass standard security steps.

Agents might also hear background noise engineered to sound like a busy home or office, crafted to disarm suspicion.

No, a Poster in the Breakroom Doesn’t Work

Modern contact centers need more than a security awareness poster in the breakroom. To truly prevent account takeover, your defense needs to be:

- Multi-layered: Combine security measures to create multiple barriers for attackers. Think CX insights provides voice biometrics, monitoring, and permission controls, all working together.

- Proactive: Don’t wait for a breach. Identify risks early with tools like real-time monitoring and agent training that anticipate tactics like social engineering.

- Frictionless for real customers: Security shouldn’t frustrate legitimate users. Tools should be secure but seamless, like voice authentication that verifies users without making them jump through hoops.

ATO prevention doesn’t have to be rocket science. You need solid steps and simple execution.

Your 5-step guide to hardening your defenses:

- Turn on multi-factor authentication and call center protocols. Go beyond flimsy security questions and add a second verification layer that makes fraudsters sweat.

- Train your team like it’s a heist movie. Teach agents how to spot manipulation tactics and enforce strict social engineering prevention policies.

- Use voice authentication. Validate callers using their unique voiceprint instead of guessing whether “Steve from Brooklyn” sounds legit.

- Role-play fraud scenarios. Make fraud prevention second nature by running realistic call simulations during agent training.

- Audit your flows and update regularly. Security isn’t a set-it-and-forget-it game; keep refining your workflows to close gaps.

Tech alone won’t save you, but paired with smart workflows and regular training, you’re building serious resilience.

Throw Out That Ancient Tech Stack

Outdated tech stacks are playgrounds for fraudsters.

What you need are real-time fraud detection tools that scan anomalies as the call happens by analyzing:

- Speech: e.g., abnormal pauses, slurred words, or overly scripted lines

- Behavior: such as excessive urgency or avoiding direct questions

- Access patterns: like repeated login attempts from new locations

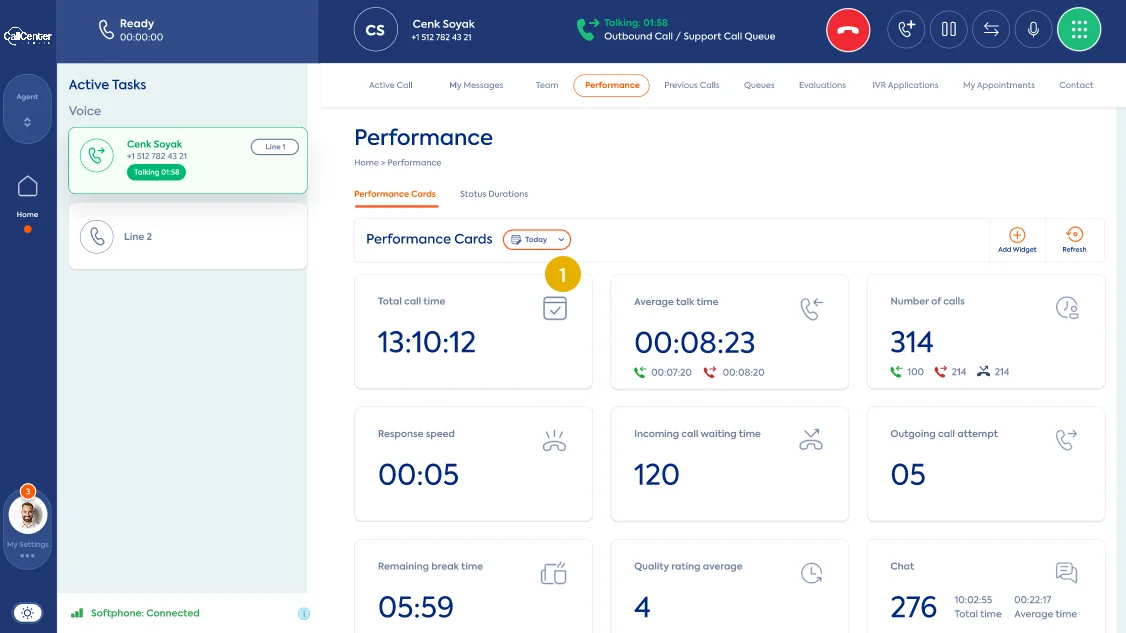

Close back doors Call Center Studio security features include:

- Call monitoring helps supervisors detect suspicious interactions in real time.

- Data masking ensures sensitive customer data like credit card numbers never reaches unauthorized eyes.

- Permission management restricts who can access what, reducing internal risks and limiting attack surfaces.

Smart platforms enable secure customer verification without slowing the experience.

Call center compliance tools should support your agents, not confuse them with 12 browser tabs and A prayer.

Culture: The Secret Sauce You’re Probably Ignoring

Tools and tech aside, it’s the culture that turns best practices into habits.

Start by reinforcing secure call center operations at every level, from leadership to part-time support reps.

- Document your protocols: For example, create a shared playbook outlining exactly how to handle suspicious callers.

- Audit regularly: Run monthly spot checks on call logs and escalation patterns to catch policy lapses early.

- Incentivize good security hygiene: Reward agents who flag potential fraud with recognition or small bonuses.

- Make detecting fraud in contact centers part of agent KPIs: Track fraud detection alongside customer satisfaction to show it matters just as much.

- Talk about fraud attempts in team meetings. Normalize awareness: For instance, share real (anonymized) cases during weekly huddles to sharpen your team’s instincts.

Include security in onboarding, refreshers, and your quarterly all-hands.

Strong security isn’t paranoia, it’s preparation.

Quick Recap

ATO fraud is growing, and your contact center is a prime target. Here’s how to stay ahead of it:

- Watch for the warning signs: Think rushed password resets, inconsistent caller info, and urgency to change account details. These are easy to miss if your agents aren’t trained to spot them.

- Use layered defenses: Combine smart tools like voice authentication, real-time fraud detection, and multi-factor authentication to stop attacks in their tracks.

- Train and empower agents: When they know what to look for and have the tech to back them up, agents become your strongest line of defense.

- Build a fraud-aware culture: A culture of contact center security comes from consistent action like daily habits, training refreshers, and leadership buy-in.

Choose the right tech partner: With a platform like Call Center Studio, you’re not just reacting to fraud, you’re blocking it before it starts.