No one wakes up in the morning thinking, “I’d love to read about payment systems today.” But if you run a business, you should. And you have to learn more about IVR payments.

Because an IVR payment system might be your hero in that sense. It is proven that this system saves money, keeps customers happy, and helps agents sleep at night.

Before entering the reasons you need to have an IVR system, we should be on the same page about what this system is all about and its working principles. (You are welcome)

What is IVR Payment?

Explaining IVR payment via a case is much more beneficial in terms of understanding it. So, let’s go through a scenario.

Sarah is on the phone with her utility provider, settling her monthly payment. The automated voice system clearly tells her: “Go ahead and enter your card number.”

Sarah taps it onto her phone, with the expiration date and security code coming right after. To keep the actual digits hidden, DTMF masking switches her button sounds to generic beeps in the background.

Then the payment portal takes care of her data securely, keeping it hidden from any agent.

Sarah ends up with a speedy, secure, and hassle-free deal, while your business enjoys an automated, rule-following payment system.

This is what IVR payment is all about.

Okay, if you’re totally clear on what IVR is and how it works, let’s go over the five super important reasons to finally get one up and running.

1. Make 24/7 Self‑Service Payments Possible

Customers no longer have access to support between 9 and 5. That is why you need an IVR. With an IVR payment integration, your customers can pay their bills at midnight in their pajamas, without requiring a human on the other end. So now, they have fewer excuses for late payments and a smoother cash flow for you. Everybody wins.

2. Lower Operational Costs in Your Contact Center

For your organization’s budget, paying an agent to answer “Can I have your card number again?” Using resources 100 times a day is not the most efficient use of resources.

IVR payment solution handles the repetitive stuff. That slashes call handling time, allowing your staff to focus on the more complex problems. That turns out to be fewer costs, more brains for the big issues.

3. Level up your security and make sure you’re good with PCI DSS.

If the phrase “data breach” makes you sweat, IVR is your solution. Because an IVR payment system ensures sensitive card information never reaches your agents’ hands, thanks to DTMF masking. (stands for Dual-Tone Multi-Frequency masking).

What DTMF is doing is simple but vital. It replaces the tones entered when customers type their card numbers with flat beeps so no one, even agents or call recordings, can capture the actual digits.

The practical side is that once you have DTMF masking and other functions with IVR payment, you know that you meet Payment Card Industry Data Security Standard (PCI DSS) compliance. Fast and simple.

4. Scale Easily & Reduce Call Volumes

Business booming? Great. Call volume exploding? Not so great.

A strong IVR payment integration scales with you, allowing more customers to pay through automation instead of overwhelming your agents. It’s basically the difference between “drowning in calls” and “running a smooth ship.” This benefit is so obvious that it does not even require further explanation. 🙂

5. Offer a Better CX and Create Customer Loyalty

The best IVR payment setups let you pay off your bill in a flash, securely, and your customers won’t have to listen to any dull music while making their payments.

By incorporating practical elements, such as recurring payments and multilingual prompts, you’ll have a system that truly aids users.

Also, your IVR system can really help you get started with establishing a program to reward loyal customers. Like, you could start a loyalty program that gives perks to folks who pay their bills on time. In that way, your company interacts more and builds stronger connections with its customers.

Another way is to blend your IVR payment service with simple email or text reminders. It will likely provide more reasons for customers to buy your service or product.

BONUS: Best Practices & Tips for IVR Payment Implementation

Want to avoid creating the IVR equivalent of a labyrinth? Stick to these tips:

Keep the flow clear.

There should be fewer prompts, easy shortcuts in your IVR menu. Do not tire the customer with a long list. Think of it like giving your customers a straight hallway, not a maze.

Offer a human escape hatch.

Simply because some people will always want to press 0, and that’s okay. 🙂

Mask and tokenize card data.

When using IVR, you must enable tokenization. Because it replaces real card details with useless strings of numbers, the stolen data becomes worthless.

Connect your backend systems.

When you integrate your backend systems (CRM, billing, and gateway), it ensures that every payment is recorded and updated in your records instantly. This is important because it prevents errors, reduces manual reconciliation, and ensures that your finance and customer data always stay in sync.

Actually track performance

You need to watch for drop-offs and error codes, and continue to improve it. In plain terms, check where customers hang up or encounter errors, and then address those issues. In this way, your IVR system stays smooth and reliable.

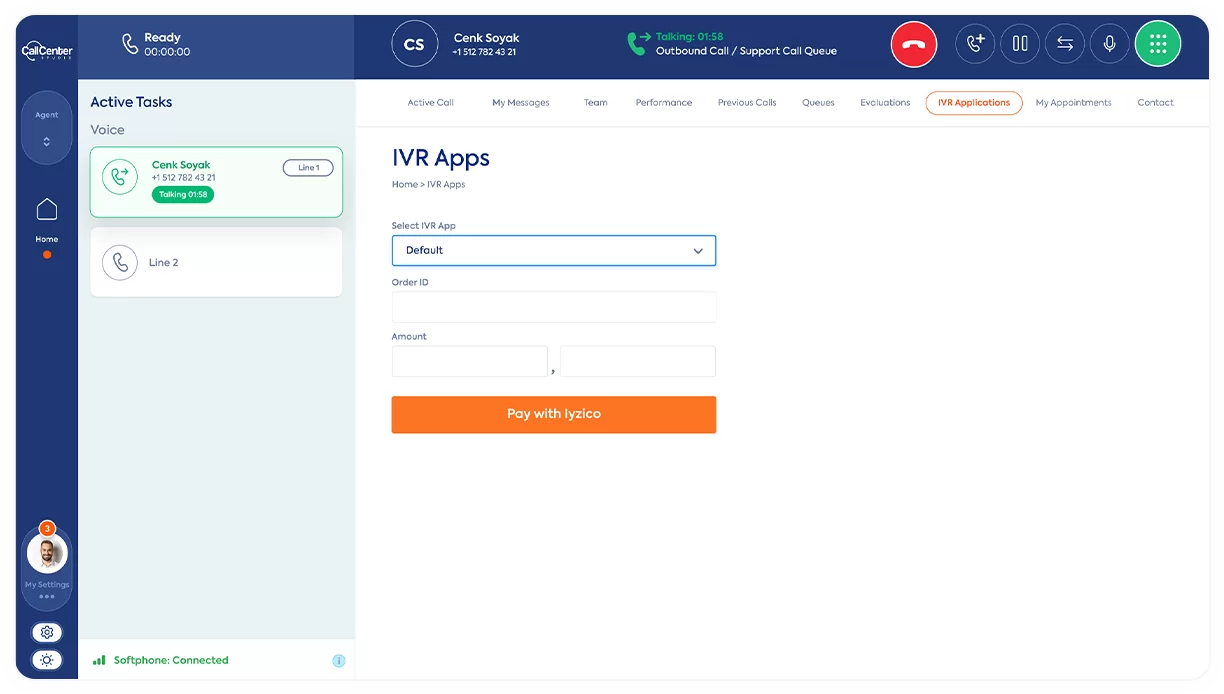

Read the case study on how Call Center Studio IVR integration works

Papara, one of the biggest online payment transfer platforms in its region, uses Call Center Studio’s IVR solutions. They put together a setup that:

- Made reports way simpler,

- Tweaked IVR setups just right, and

- Allowed for constant help.

The outcome was quite positive: transactions went through without a hitch, people didn’t have to wait as long, and the call center significantly improved its efficiency.

We recommend that you abandon traditional methods and adopt an IVR payment system. It’s smart, secure, saves you a bundle, and keeps everyone happy.

If you need someone to lead you for your IVR journey, you are not alone. Please contact us and we will prepare a personalized demo for you.